NYCDEP Begins Final Phase of $2 Billion Delaware Aqueduct Bypass Tunnel Repairs

NEW YORK – New York City loses millions of gallons of water each day from leaks in the Delaware Aqueduct Tunnel upstate, the equivalent of

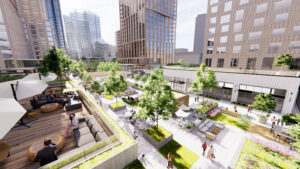

NYPA Trustees Approve Moving Forward On New Corporate HQ in White Plains

WHITE PLAINS—The New York Power Authority Board of Trustees approved a request on Oct. 8 authorizing staff to negotiate a binding development agreement with the

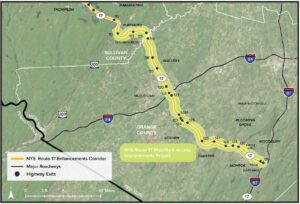

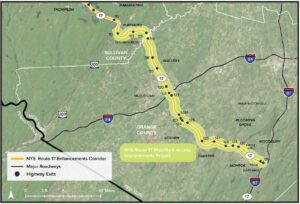

NYSDOT Report: Route 17 Expansion Alternatives To be Studied Will Cost More Than $1.3B Each

ALBANY—A review of the 132-page “Scoping Report” for the “NYS Route 17 Mobility and Access Improvements Project” also known as the Route 17 expansion project,

New York City Update – MTA Commits to $7.5 Billion in Capital Plan Contract Awards to MWBE/DBE/SDVOB Firms

NEW YORK—The Metropolitan Transportation Authority announced Sept. 30 its commitment to award a historic amount to historically underutilized businesses as part of its recently announced

U.S. Construction Jobs Swell By 25,000 in September

WASHINGTON— Construction sector employment rose by 25,000 jobs in September as both nonresidential and residential contractors added workers at a faster clip than other industries,

Attorney’s Column – Court Directs Parties to Arbitration Despite the Lack of a Signed Agreement

When most disputes come to a head, the battle cry is “I’ll see you in court!” In connection with construction disputes, that battle cry often

Con Edison Begins Construction on $1.2B Project To Support Electrification of JFK Airport, MTA Buses

NEW YORK—On Oct. 1, Con Edison marked the start of construction of its Reliable Clean City – Idlewild Project, which will support the electrification of

What Does New York State’s Deregulation Of Marijuana Mean for the Workplace?

In general, the deregulation of marijuana has led to implications on drug testing policies and employee rights. Employers should consider removing THC from their pre-employment

Economic Outlook – What are the Short-Term Economic Policy Impacts of U.S. Presidential Elections?

The period leading up to a U.S. presidential election is often characterized by significant uncertainty and market volatility. As candidates run for office, investors, businesses

Making a Career of it

Six years ago, Rob Tirella got a phone call from a friend, a member of Laborers 235, offering him the opportunity to join a union.

Montefiore Health Plans $41M Expansion, Modernization at Mount Vernon Hospital

MOUNT VERNON—Montefiore Health System officials unveiled late last month what they termed transformative plans for Montefiore Mount Vernon Hospital designed to meet the community’s healthcare

Financial Management – Preparing for the Election: Let’s Compare Tax Proposals of Candidates Harris and Trump

The 2024 presidential election presents a pivotal moment for the construction industry. Both Vice President Kamala Harris and former President Donald Trump propose contrasting tax

City of Newburgh Completes $32-Million North Interceptor Sewer Improvement Job

NEWBURGH, NY—New York State, City of Newburgh and environmental activists gathered on Oct. 8 to celebrate the completion of the $32-million North Interceptor Sewer Improvement

Safety Watch – Contractors Beware: OSHA Can Cite You For the Work and Actions of Your Subs

The realities and complexities of modern-day construction make it likely that a contractor will use subcontractors to perform a portion of those activities and their

The Top in-Demand Jobs In Building, Construction

Construction activity serves many masters, both as a leading economic indicator of what is occurring and as a cornerstone of economic development for what lies

Future of NY Transportation Hangs in the Balance As MTA Faces Ways to Plug Massive Funding Gap

ALBANY—As it prepares to submit its 2025-2029 Capital Program, the Metropolitan Transportation Authority must find billions in new funds even as the state tries to

Building Trades Leaders Are Optimistic Robust Volume Will Sustain Thru 2025

TARRYTOWN—As the nation enters the final stretch of the Presidential campaign season, jobs are on the minds and lips of everyone. And the jobs that

ECCO III Completes Major Rebuilding Project Of Storm King Highway Ravaged by Flooding

HIGHLAND, NY—State Route 218 in the Town of Highlands in Orange County has reopened to traffic for the first time since devastating floods in July

Contractors, Unions Boost Awareness Of Industry’s Problems, Suicide Rates

ALBANY—As National Suicide Prevention Month continues through September, experts are urging companies to cultivate a stronger “culture of care” to support their crews and staffers.

Attorney’s Column – Performance Bond is Not an Insurance Policy For Later Claims Brought for a Contract Breach

Performance bonds are a familiar tool in the construction industry – particularly on public works and larger private projects. Their purpose is to provide an

U.S. Supreme Court Justice Sonia Sotomayor Cuts Ribbon on New School Named in Her Honor

YONKERS, NY—U.S. Supreme Court Justice Sonia Sotomayor arrived here in mid-September to celebrate the opening of the Yonkers Public School District’s newly constructed school named

Should Congestion Pricing Go Before Voters? Gov. Hochul’s Lawyers Want Issue on Ballot

ALBANY—In public, Gov. Kathy

Hochul has repeatedly said her order to

pause congestion pricing was motivated

by economics, not politics. But behind<br

Albany Update – Sloatsburg Service Area on Thruway Reopens

ALBANY—The New York State Thruway Authority announced on Sept. 10 the reopening of the newly renovated Sloatsburg Service Area located on I-87 northbound between exit

Bill Now Requires GCs, Subs to Submit Payrolls to Certified Electronic Database

NEW YORK—In advance of the New York City Labor Day Parade, on Sept. 7, New York Gov. Kathy Hochul signed eight pieces of legislation aimed

MTA Proposes $68.4B Capital Program; Viable Funding Sources in Question

NEW YORK— The Metropolitan Transportation Authority released its proposed 2025-2029 Capital Plan on Sept. 18, outlining a $68.4-billion investment in the region’s subways, buses, railroads,

Obituary – Anthony Cellini

MONTICELLO, NY–The veteran Sullivan County politician and businessman Anthony “Tony” Cellini passed away on Sept. 6 at the age of 83.

Financial Management – Employee Retention Credit Processing Updates: Here’s What Construction Firms Need to Know

Did you apply for the Employee Retention Credit over the last few years only to face daunting delays? ERCs were a refundable tax credit introduced

City Voters Delivered $4.2B Green Bond Act; But Funding Formulas Steer Dollars Upstate

NEW YORK— Expecting to see green, New York City officials are seeing red instead.

Approved by voters statewide in 2022, the Clean Water, Clean

Feds to Provide $3.8M to Help Build IBEW Offshore Wind Training Facility

WASHINGTON—As employment opportunities in the sustainable energy sector advance, elected officials representing New York State announced $3,828,000 in federal funding for the Educational and Cultural

America’s Bridge Repair Campaign Witnesses Slow & Steady Gains as ‘Poor’ Spans Decline

WASHINGTON—Nearly 221,800 U.S. bridges need major repair or replacement, a major national construction trade association reported following an analysis of recently released federal government data

State Certifies 31 New Climate Smart Communities

ALBANY—The latest round of communities to achieve certification as part of New York State’s Climate Smart Communities Certification program, which supports local efforts to meet

NYC Opens 24 New School Buildings In Advance of 2024-2025 School Year

NEW YORK – New York City announced on Sept. 4 the completion and opening of 24 new school buildings, including 11,010 new seats, across the

600 Hudson Valley Students Eager to Explore Careers In the Building Trades at 24th Annual Expo in 2025

SUFFERN, NY– Planning is underway to welcome more than 600 local high school students who will meet with experts in the Building & Construction Trades

Safety Watch – Firm’s Well-Crafted Safety Plan Proved Worthless, Leading to OSHA Fine for Willful Repeated Risk

Although the decision of Secretary of Labor v. Trinity Solar, LLC specifically pertains both to the use of hard hats and fall arrest systems necessary

CIC Softball Reunion Scores Big For Ukrainian Humanitarian Relief

TARRYTOWN, NY—With a final score that was more indicative of football game than a softball contest, the annual CIC Softball Classic was tied after six

Washington Update – FAA to Allocate $59 Million For Upgrades at 26 NY Airports

WASHINGTON—U.S. Senate Majority Leader Charles E. Schumer and U.S. Sen. Kirsten Gillibrand announced on Sept. 4 that $59,115,204 in federal funding has been allocated to

What’s New & Who’s News

A roundup of what’s new and who’s in the news both locally and in the state.

PJS Montesano JV Begins Work On $1.9B Kensico Water Tunnel

VALHALLA, NY—In late July, officials of the New York City Department of Environmental Protection, local officials in Westchester and construction professionals threw the ceremonial “first

Turner Begins Work on $220M Expansion At Westchester Medical Center Project

VALHALLA, NY—New York State Lt. Governor Antonio Delgado was among the many dignitaries that joined Westchester Medical Center Health Network’s leadership on July 24 to

Ossining Breaks Ground on Record $100-Million Water Treatment Plant

OSSINING, NY—A host of elected officials celebrated the official groundbreaking for the new Indian Brook Water Treatment Plant—the largest infrastructure project in Ossining’s history. It

COMMENTARY – Stuck Bridges, Buckling Roads Sound Alarms That America’s Aging Infrastructure is in Distress

WASHINGTON—More than $450 billion in infrastructure spending has already been awarded to states and cities through the Infrastructure Investment and Jobs Act passed in 2021.

MTA Advisory Committee Slams Congestion Pricing Alternatives

NEW YORK—The Permanent Citizen’s Advisory Committee to the MTA released a new report earlier this month entitled “Funding the MTA’s 2020-2024 Capital Plan: Evaluating Proposed

Halmar Int. Completes Major Construction On U.S. Rte. 1 Bridge Over Mamaroneck River

MAMARONECK, NY — New York State officials announced on Aug. 2 that major construction was completed on a project that reconstructed the bridge carrying U.S.

Attorney’s Column – Ambiguous Contract Sends Dispute to Trial And Prevents Summary Resolution of Claim

This column often stresses the important provisions to include in construction contracts. Among them are thorough indemnification clauses, dispute resolution provisions and adequate insurance provisions.

Economic Outlook – NYC Metro Commercial Real Estate Sector Improving Marginally So Far This Year

As of mid-2024 most reports of the U.S. economy were positive, despite geopolitical uncertainty, lower inflation, the prospect of interest rate cuts, and continued employment

New York City Council Approves Bronx Re-Zoning; Adams Admin. Commits to $500M in Improvements

NEW YORK—On Tuesday (Aug. 6) the New York City Council’s Committee on Land Use voted to approve the Bronx Metro-North Station Area Study rezoning proposal

Albany Update – Funding Will Allow Second Ave. Subway Project to Continue

ALBANY—New York Gov. Kathy Hochul announced on Tuesday (July 30) that the state will provide $54 million to support utility work that will allow the

Construction Advancement Institute Awards $70,000 in Academic Grants to 14 Students

Construction Advancement Institute Awards $70,000 in Academic Grants to 14 Students August 20, 2024 TARRYTOWN, NY—As part of its mission to elevate professionalism in the

Darante Construction, Ltd.

Now in its second generation as a thriving mason contracting enterprise, Darante Construction, Ltd. was established in 1986 by the late Genesio Fante who found

Hunter Roberts Prismatic JV Named Low Bidder On $326M Mid-Hudson Forensic Hospital Project

ALBANY—The New York State Dormitory Authority opened bids on the General Construction component of the Mid-Hudson Forensic Hospital project in New Hampton, NY on Aug.

300 Munis Seek Pro-Housing Certification To Tap Into $650 Million in State Funding

EAST HAMPTON, NY—New York Gov. Kathy Hochul announced on Aug. 9 that 335 New York municipalities have launched applications to be certified as Pro-Housing Communities,

15 Students Share $75,000 in College Scholarships From CIC/Louis G. Nappi Management-Labor Fund

TARRYTOWN, NY— Fifteen college and graduate students will begin the new academic year each with a $5,000 grant from the Louis G. Nappi Construction Labor-Management

Financial Management – The Financial Impact of Project Delays: Prevention and Mitigation Strategies

In this post-COVID era, the construction industry grapples with unpredictable project delays that can severely affect the profitability of a job and the company. Despite

Safety Watch – Risk of Cave-Ins, Trench Collapses Pose Significant Perils and Fines for Contractor

Over the past decade, at least 250 workers have died from cave-in or trench collapses. Because of the significant peril that can result from these

What’s New & Who’s News

A roundup of what’s new and who’s in the news both locally and in the state.

Washington Update – ARTBA Chair Testifies that a Maze of Policy Changes May Complicate IIJA Implementation

WASHINGTON—While more than 75,000 transportation improvement projects have been initiated, including one in nearly every congressional district, and 43,000 construction jobs have been created by

NYC Office Building Market Sees Values Rise Amid Shift in Demand for Space

NEW YORK—Office buildings in New York City remain a critical contributor to its economy and tax base, as market values reached nearly $205 billion in

Port Authority Sees $24M Funding For Stewart Runway Project in 2017

NEW YORK—The Port Authority of New York and New Jersey announced on Aug. 12 that New York Stewart International Airport had received a $24.2-million grant

MTA to Defer $16.5 Billion In Capital Projects, Repairs

NEW YORK—The fallout from the decision by New York Gov. Kathy Hochul last month to put the New York City congestion pricing tolling program on

Gateway Tunnel Job Taps Final $6.8B in Fed Funds

NEW YORK—Federal and state officials joined the Gateway Development Commission, Amtrak and NJ Transit executives to announce the final federal funding in place for the

Yonkers Contracting Begins Major Projects To Replace Bronx Bridges, Valued at $517M

ALBANY—New York State officials announced late last month the start of a $517.5-million project to replace two bridges along the Bronx River Parkway between East

Gov. Hochul Meets with Local 825 Leaders, Reaffirms Commitment to Infrastructure

NEW HAMPTON, NY—The International Union of Operating Engineers Local 825 (IUOE) hosted Gov. Kathy Hochul at its New York Training Center on July 10 to

Countdown Begins for Selecting A Downstate Casino Gaming Site

ALBANY—The New York State Gaming Facility Location Board recently unanimously approved an updated timeline for the Request for Applications for downstate commercial casino licenses, commencing

Obituary – Francis X. McArdle

DANVER, MA—New York State lost a true icon of construction industry leadership earlier this year when longtime association executive and advocate Francis X. McArdle, former

OSHA Releases Proposed New Regulation On Heat Injury, Illness Prevention Rule

WASHINGTON—The Occupational Safety and Health Administration has released a proposed rule intended to reduce heat injuries, illnesses, and deaths. Excessive heat exposure has been identified

Attorney’s Column – Appellate Court: ‘Paperwork Breach’ Dooms Claim

While most contractors strive for excellence in their construction—after all, it’s the product of their ingenuity and know how that will potentially be around for

NYC Reaches $112.4B Budget Accord With $2B to Build Affordable Housing

NEW YORK—With negotiations extending down to the wire, New York City Mayor Eric Adams and the New York City Council agreed on a new $112.4

Bear Mountain Bridge Marks Centennial With Festivities Spanning Many Interests

HIGHLAND, NY—The countdown has begun in celebration of the 100th anniversary of the venerable Bear Mountain Bridge, the Hudson River’s first vehicular crossing south of

New Rochelle to Spend $10M on Flood Mitigation To Upgrade Aging Stormwater Infrastructure

NEW ROCHELLE, NY—The City of New Rochelle announced recently the launch of the first flood mitigation project as part of its $10-million investment into the

Albany Update – More than $33M in Road Work Begins in Westchester County

ALBANY—Work has begun on infrastructure projects in the lower Hudson Valley that will promote resiliency along key corridors in Westchester County.

CIC Golf Classic Staged At Sleepy Hollow Country Club

SCARBOROUGH, NY—There were 188 spirited golfers who took on high temperatures and the legendary Sleepy Hollow Country Club on Mon., July 8, for a day

Next Generation Leader – Pat Fortunato

Next Gen Leaders Profiles of the Industry’s New Generation Pat Fortunato Age: 25 Current Employer: JPMorgan Chase Position / Job Title: Software Engineer University and

Financial Management – High-Impact Legislation, Innovation and Resolve Are Drivers for Challenging Construction Season

Despite the challenges of inflation and economic uncertainties, the buoyant construction industry is poised for an interesting second half of 2024. Impactful legislation, innovative practices,

What’s New & Who’s News

A roundup of what’s new and who’s in the news both locally and in the state.

Safety Watch – Avoid Perils During Loading And Stacking Operations

During loading and stacking operations, coordination between the operators of powered industrial vehicles and their spotters is necessary in cases of instability hazards to avoid

Firm Picked to Redevelop Downstate Correctional In Dutchess with Mixed-Use, Community Space

FISHKILL, NY—In stark contrast to the prison it once was, the repurposed correctional facility here is hoping to see lots of people come and go

Port Auth. Signs Two Hangar Leases At Stewart Valued at $119 Million

NEW WINDSOR—The Board of Commissioners for the Port Authority of New York and New Jersey approved two new corporate hangar leases at New York Stewart

MTA Sees Projects on the Chopping Block, Due to Gov’s Congestion Pricing ‘Pause’

NEW YORK—How will the MTA plug the day-to-day operating funds to offset the loss of $15 billion in bond funding, which the agency had planned

Westchester Joint Water Works Seeks Filtration Plant Bid by Late 2024

MAMARONECK, NY—The Westchester Joint Water Works has recently entered into a consent decree with the U.S. Environmental Protection Agency and the New York State Department

Showcase Unionism

The Greater Hudson Valley BSA Council visited the Operating Engineers Local 137 training center in Montrose, NY on Sat., June 15, to explore what it

State Awards $67M to Seed Development Of 2,400 New Homes in Mid-Hudson Region

HYDE PARK, NY—State officials last month unveiled the first 13 awards totaling $67 million under the Mid-Hudson Momentum Fund, a $150-million initiative geared to increasing

State EFC Approves $120M in Funding For Local Water Infrastructure Projects

ALBANY—The New York State Environmental Facilities Corporation Board of Directors recently approved more than $120 million in financial assistance for water infrastructure improvement projects across

Attorney’s Column – Court: Not All ‘Incorporated’ Provisions Of an Upstream Contract Flow to the Sub

This column has often written about issues that affect contractor/subcontractor relations because subcontracting is ubiquitous in the industry. One of the most important aspects of

New York State Maps Out 21 DRI, NY Forward Projects in Four Hudson Valley Communities

ALBANY—New York named 21 transformational projects for the Mid-Hudson region as part of two economic development programs: the Downtown Revitalization Initiative and NY Forward.

Economic Outlook – War in Ukraine Exacerbating Global Economic Volatility

The war in Ukraine has profoundly impacted the global economy, with ripple effects extending far beyond its borders. This conflict originally disrupted vital energy supplies,

Jorrey Excavating Inc

Jorrey Excavation Inc, a certified women-owned business, provides timely excavation and milling/scarifying services for a variety of clients with public works projects.

Congestion Pricing – Pros & Cons

TARRYTOWN, NY—When it comes to problem solving, New Yorkers can be like a large family that finds new ways to fight over the very things

67th Annual BCA Golf Outing Draws 75 Golfers, 105 Dinner Guests

WHITE PLAINS, NY—The Starter’s sheet of tee-times was brimming with more than 19 golf foursomes who entered the 2024 BCA Golf Outing here at Westchester

Financial Management – Key Strategies Contractors Can Employ In Periods of Elevated Interest Rates

Interest rate changes directly impact construction companies in a variety of ways, beginning with the affordability of borrowing and availability of financing. To battle these

Next Generation Leader – Anthony Sanseverino

Next Gen Leaders Profiles of the Industry’s New Generation Anthony Sanseverino Age: 23 SUMMARY: Anthony’s dream of becoming an engineer began in high school, when

Safety Watch – Internal Traffic Control Plans Offer Protections To Work Zone Crews During Paving Operations

With their constant movement of heavy equipment and workers on foot, road paving operations are dynamic worksites that can experience struck-by hazards if crew members

What’s New & Who’s News

A roundup of what’s new and who’s in the news both locally and in the state.

NYCHA Signs 2024 PLA with Building Trades

NEW YORK – The New York City Housing Authority announced on Feb. 29 the signing of the 2024 Project Labor Agreement (PLA) with the Building

Flat FY2025 State Budget for Roads Underscores Needs for Transportation

SLEEPY HOLLOW, NY—Despite widespread support from regional lawmakers to add millions of dollars to the FY2025 state budget for Hudson Valley roads and bridges, the

GWB $2B Rehab Passes Halfway Mark

NEW YORK—After nine decades of standing tall and serving as the most important piece of transportation infrastructure in the nation, the George Washington Bridge is

Route 17 Expansion Project Details Posted in Federal Register Filing

TOWN OF WALLKILL, NY—In advance of two public scoping sessions this month on improvements or expansion possibilities for Route 17 through Orange and Sullivan counties,

Regional Roundup – MTA Completes Multi-Year Metro North Croton Harmon Yard Maintenance Project

CROTON-ON-HUDSON, NY—Major upgrades to MTA Metro-North Railroad’s vital maintenance and operations hub at Croton-on-Hudson, NY, which employs 1,200 people, was announced earlier this month.

Congestion Pricing Delays Put $9B In 2024 MTA Capital Projects at Risk

ALBANY—New York State helped stabilize the MTA’s finances last year, but its capital program for maintaining and upgrading the regional transit system faces significant delays

NYS Thruway Worker Killed; Another Seriously Injured

ALBANY—Just weeks after recognizing Work Zone Awareness Week in New York State (April 15-19), an accident at an upstate work site claimed the life of

Attorney’s Column – Court: For Work Where a License is Required, One is Needed to Recover in Event of a Claim

The ostensible purpose of contractor licensing statutes is to ensure that the public’s health and welfare is protected by permitting only qualified contractors to work

Peckham Centennial Celebration

Great ideas in business are often hatched at kitchen tables. A century ago, on March 17, 1924, William H. Peckham, Jr., along with his father-in-law

NYC Building 5-Ft. Wall in Lower Manhattan To Battle Sea Level Rise, Stronger Storms

NEW YORK –In its ongoing battle to protect people and property against damage caused by rising sea levels and stronger storms, New York City on

Woodbury Common Expansion Project Calls for 20 New Store Openings in 2024

CENTRAL VALLEY—The owner of the Woodbury Common Premium Outlets, which previously announced plans for a $250-million expansion project, recently updated other upcoming customer experience enhancements

Engineering EXPO 2024 Attracts Students, Parents Exploring P.E. Careers

WHITE PLAINS NY—The popular annual exposition promoting STEM subjects, the Tri-State ENGINEERING EXPO, returned to White Plains High School on Sun., April 14, attracting more

Financial Management – New York’s Prompt Payment Act Imposes Stricter Deadlines on Developers, Owners

On Nov. 17, 2023, New York State amended its Prompt Payment Act, which regulates private commercial construction contracts that exceed $150,000. The amendments introduced in

Next Generation Leader – Jack Badick

Next Gen Leaders Profiles of the Industry’s New Generation Jack Badick Age: 23 Current Employer: Department of Defense Naval Undersea Warfare Center, Newport, RI Position

What’s New & Who’s News

A roundup of what’s new and who’s in the news both locally and in the state.

Safety Watch – Recent Thruway Tragedy Underscores Mission-Critical Tasks in Work Zones

Sadly, there are painful reminders of the danger posed to workers during roadway maintenance and repair operations. As we now enter the summer months—the height

Voters Approve $24M Bond For New Thiells Firehouse

THIELLS, NY—The Thiells Fire Department won the support of voters on Tues., April 30, when community residents here in the hamlet in the Town of

Construction Leaders, Elected Officials Discuss Key Projects at HVCIP Luncheon

CHESTER, NY—The 10th annual Hudson Valley Construction Industry Partnership (HVCIP) luncheon at the Glenmere Mansion here on Tues., April 8, drew a record attendance of

New Federal Funding to Clarkstown For DPW Project to Combat Flooding

WEST NYACK, NY—The Town of Clarkstown announced it will receive more than $2.1 million in federal funding to fix conditions that cause widespread flooding and

Argenio Brothers Start $11M Roundabout At Key Intersection Near Vassar College

POUGHKEEPSIE, NY—New York State officials announced on April 5 that work will soon begin on a $11.4-million project to reconfigure the intersection of State Route

Bridge Authority Hosts M/WBE & SDVOB Meet & Greet

NEWBURGH, NY– The New York State Bridge Authority held its first-ever M/WBE & SDVOB Meet & Greet event on March 28 at the Newburgh campus

Commentary – PLAs Offer Accountability, Efficiencies On Large-Scale SUNY Building Projects

With the annual-budget negotiations in Albany now in overtime, blue collar workers are calling on policymakers to pass legislation that will restore accountability and bring

Appeals Court Lacks Jurisdiction To Hear Prevailing Wage Challenge

ALBANY—The Appellate Division of the New York State Supreme Court affirmed on Thurs., April 11, an initial decision rendered last fall by Supreme Court Justice

Attorney’s Column – Court Holds that Vague Arbitration Clause Is Still Sufficient to Compel Parties to Arbitrate

One clause that is often overlooked as boilerplate when negotiating a construction contract is the arbitration or, more broadly, ADR (Alternative Dispute Resolution) clause. There

Construction Sector Must Contend With Legal Marijuana in the Workforce

NAPLES, FL—Legal marijuana has become a major concern for construction employers with statistics showing it is contributing to more accidents, worsening the health of workers

Washington Update – Feds Award $24M Flood Mitigation In Westchester

WASHINGTON—U.S. Senate Majority Leader Charles E. Schumer announced on April 8 a total of $23,960,000 in federal funding has been approved to strengthen flood mitigation

Albany Update – NY State Environmental Facilities Corp. Closes $717-Million Bond Sale

ALBANY—President and CEO Maureen A. Coleman announced on April 2 that the New York State Environmental Facilities Corporation had successfully closed a $717-million bond sale

Hudson Valley Students Learn About Trade Skills, Careers at 24th Annual Construction Career Day

SUFFERN, NY—High school students from across the Hudson Valley met with building trade experts to participate in skills-building activities and learn about union careers at

Students Explore Career Opportunities At Annual Union Apprenticeship Expo

More than 700 students from 34 schools attended the expo on April 12 at Rockland Community College in Suffern.

Financial Management – ESOPs Offer Smooth Exit Strategies for Owners

It’s a conundrum more common than you might think: the owner (or owners) of a privately held, mid-size construction company is getting older and considering

What’s New & Who’s News

A roundup of what’s new and who’s in the news both locally and in the state.

Safety Watch – Company Liable for Failing to Document Violations of Safety Policy Regulations

In this era of labor shortages and the constant need to secure adequate staffing, construction companies have to balance the practical needs of their business

Economic Outlook – Lower Hudson Valley Successes Fuel Rising Housing Prices, Stoking Demand

The recent economic trends in the Lower Hudson Valley will have far-reaching implications for the region’s future. A thriving job market, flourishing commercial real estate

NYS Senate, Assembly Hike Funding Levels In FY2025 Budget for Hudson Valley Roads

TARRYTOWN—The advocacy efforts of the Hudson Valley region’s construction industry, led by the Construction Industry Council of Westchester & Hudson Valley, Inc., and organized union

Region’s Union Building Trades Leaders Map Out Major Project Pipeline for 2024

TARRYTOWN—Attendees of the Hudson Valley Construction Industry Partnership convention late last month in Naples, FL attended a host of highly informative presentations and roundtable discussions

County Executive Latimer Signs Nearly $53 Million Glen Island Bridge Bond Act

WHITE PLAINS—In his Seventh State of the County address on March 14, Westchester County Executive George Latimer signed the $52.8-million Glen Island Bridge construction Bond

Guest Viewpoint – Route 17 Upgrade Will Enhance Safety, Mobility, Create Meaningful Jobs to Boost the Economy

When faced with challenges, leaders act. Problems require solutions, and if ignored, problems often become worse over time. A present-day case in point is Route

Attorney’s Column – GC’s Exaggerated Mechanic’s Lien Sinks Claim To Recover and Drowns its Subs in the Process

It’s always a bad idea to exaggerate the amount of a mechanic’s lien. While the exaggerating lienor may succeed in getting the attention of the

Despite Optimism for Select Sectors, CEO Confidence Index Hits Near Lows

HYDE PARK, NY—A survey released on March 5 by the Siena College Research Institute of more than 500 upstate business leaders showed optimism that several

Biden FY25 Budget Seeks Heavy Spending For DOT, Army Corps

WASHINGTON—Thanks to the funding levels that are part of the $1.2 trillion IIJA, President Joe Biden’s budget proposal for fiscal year 2025 is sticking with

PSC Approves $57.8M Rockland Power Line

ALBANY —The New York State Public Service Commission recently approved plans by Orange and Rockland Utilities, Inc., for a new two-year electric system construction project,

Safety Watch – Fall Protection Must Be Provided to All Employees Working at Heights Greater than Six Feet

The Occupational Safety and Health Review Commission’s decision in Secretary of Labor v. Gate Precast Company reaffirms the safety requirements for construction companies that have

HVCIP Mid-Winter Meeting

HVCIP MID-WINTER MEETING

Ritz-Carlton, Naples, Florida • February 25 – February 29, 2024. 175 Members and Guests Convene to Discuss Management & Labor Concerns,

Yonkers IDA Helps Advance Teutonia Hall Project With $17.5M Incentives for Riverfront Development

YONKERS, NY—The long-anticipated redevelopment of the Teutonia Hall site on Buena Vista Avenue here is primed to move forward following final approval of financial incentives

Orange County Advanced Manufacturing Project Secures New York State Shovel-Ready Grant

MONTGOMERY, NY—A proposed project to locate a multi-building advanced manufacturing complex at the Aden Brook Commerce Park here was one of seven winners of the

Financial Management – Keep Good Records on PPP Loan Forgiveness. Lookback on SBA Challenge is Up to 10 Years

Many companies that have submitted documentation to the Small Business Association and that have had Paycheck Protection Program loans forgiven may think they are home

Making a Career of it

Making a Career of It Joseph Szabo Journeyman – Carpenters Local Union 279 Age: 36 Recent Employers: WD Installations, Inc. Recent Projects: Lasdon Park main

What’s New & Who’s News

A roundup of what’s new and who’s in the news both locally and in the state.

Building Trades Confident Road, Energy, Sewer Work Will Lead to Busy 2024

TARRYTOWN—Union building-trades officials in the Lower Hudson Valley express confidence that despite the economic headwinds and challenges of last year, several of the main economic

NYSDOT Lists 42 Projects, Valued at $376M, For Mid-Hudson Anticipated Lettings in 2024

POUGHKEEPSIE, NY—The New York State Department of Transportation recently released its anticipated project list for the 2024 letting season for the seven counties in the

TRIP Report Calculates Poor Roads, Bridges Cost New York City Area Motorists Nearly $37 Billion

NEW YORK—Roads and bridges that are deteriorated, congested or lack some desirable safety features cost New York motorists a total of $36.7 billion statewide annually—$

Coalition Demands More State Funding To Repair Hudson Valley’s Crumbling Roads

ELMSFORD, NY—A major coalition led by the Construction Industry Council of Westchester & Hudson Valley and construction trade unions is demanding that state lawmakers allocate

Attorney’s Column – Relying on Drawings Alone for Calculating Bid Failed to Show a Project’s True On-site Conditions

When first deciding to undertake a construction project, be it public or private work, contractors often start by reviewing the drawings—the graphic representation of what

Poughkeepsie Firm Named Apparent Low Bidder On Mid-Hudson Forensic Hospital Asbestos Job

ALBANY—The New York State Dormitory Authority has reported on its website that an apparent low bidder has been named for the first project in what

Safety Watch – Tragedy Illustrates Why Contractors Must Coordinate With Engineers to Establish and Update Rigging Plans

The decision in Secretary of Labor v. Tower King, II, Inc. should serve as a reminder to the construction industry, and companies specifically involved in

Annual CIC NYSDOT Region 8 Construction Safety Seminar

HYDE PARK, NY—The annual CIC/NYSDOT Region 8 Safety Seminar held at the Culinary Institute of America here on Tues., Jan. 30, drew a record attendance

Financial Management – Design-Build Procurement to Shape Future Of Construction for City of New York: DDC

In an effort to increase efficiency and reduce complexity in the construction process, the recently appointed Associate Commissioner of Alternative Delivery for New York City’s

Albany Update – NY State Awards $215M In Water Quality Funding

ALBANY—In separate announcements on Feb. 15, New York announced awards of more than $166 million in grants to 187 water quality projects throughout the state.

Washington Update – New EPA Air Quality Standard Termed an Overreach by ARTBA

WASHINGTON — The Biden-Harris Administration on Feb. 7 finalized a significantly stronger air quality standard that officials say will better protect America’s families, workers, and

Teamsters L.U. 456 Creates On-the-Job Trainee Program

ELMSFORD, NY—Teamsters Local 456 has created an on-the-job training program that enables a CDL-licensed driver/trainee to ride along in construction vehicles with an experienced driver/employee

Westchester IDA Marks Banner Year in 2023 With $2B, Propelled by Regeneron Expansion

WHITE PLAINS—The $1.8-billion expansion of Regeneron Pharmaceuticals has once again put economic development activity incentivized by the Westchester County Industrial Development Agency in the billions

Local Sales Taxes Grew 4.2% in NY State To $23 Billion in 2023, Comptroller Reports

ALBANY—Local government sales tax collections in New York State, fueled by growth in New York City sales taxes, totaled $23 billion in calendar year 2023,

Real Estate Broker’s Forecast Sounds Alarm on Office Sector

WHITE PLAINS—A panel of real estate brokers and developers offered a candid and unvarnished assessment of Westchester County’s multifamily, industrial, medical and office markets heading

Putnam County Exec. Calls for Restoration Of $60-Million Reduction to CHIPS Program

ALBANY—In testimony provided at the New York State Joint Legislative Public Hearing on the 2024 Executive Budget on Transportation earlier this month, Putnam County Executive

Filings for Large Multifamily Projects In NYC Remain at Historic Lows: REBNY

NEW YORK—The Real Estate Board of New York’s recently released New Building Construction Pipeline Report for the fourth quarter of 2023 states that New York

Viewpoint – Rockland’s Office of Buildings & Codes Issues Record Number of Violations, Fines Since 2022 – by Ed Day

Two years ago this month, we fulfilled an order by New York State Department of State (NYSDOS) to assume all functions and responsibilities of the

Economic Outlook – The Economic Effects of Cyber Attack

In our interconnected world, where the global economy relies heavily on digital infrastructure, the specter of cyber attacks looms large. Federal regulators often have said

White Plains Granted $10M in Downtown Revitalization Funding by New York State

WHITE PLAINS, NY—The City of White Plains was honored this month as a recipient of this year’s Downtown Revitalization Initiative Mid-Hudson Region and will receive

What’s New & Who’s News

A roundup of what’s new and who’s in the news both locally and in the state.

Gov. Hochul Seeks Large NYC Projects, Housing, Climate Change Goals in Her FY25 Proposed Budget

ALBANY—Gov. Kathy Hochul used her two spotlight appearances here this month to lay the groundwork for what her administration will seek in the annual budget

‘Blistering Pace’ of Growth in Bridge, Highway Construction, ARTBA Reports

WASHINGTON—Roadbuilders and their suppliers can expect a banner year in 2024, with industry experts projecting record spending on infrastructure projects thanks to the bipartisan Infrastructure

NYSDOT Updates Public on Progress On Rte. 17/I-86 Conversion/Exit 122 Job

TOWN OF WALLKILL, NY—The New York State Department of Transportation hosted public information sessions on Jan. 17 at the Town of Wallkill Community Center and

CIC Marks Milestone 45th Anniversary in 2024 With Special Presentations Planned at Events

TARRYTOWN, NY—The Construction Industry Council is celebrating its 45th anniversary this year with a host of events to mark the milestone since its first full

Attorney’s Column – Court Frowns on Claims Asserted Outside A Contractor’s Own Chain of Contract Privity

Anyone who has undertaken a construction project knows there are many activities to be coordinated, with many different people performing these activities. It is also

Warmer Winter Helping Construction DPW Projects Advance in Region

CHESTNUT RIDGE, NY—The head of the Rockland County Highway Department recently told CONSTRUCTION NEWS that these past two milder winters in the region has allowed

Next Generation Leader – Andrew Griffin

Next Gen Leaders Profiles of the Industry’s New Generation Andrew Griffin Age: 25 Current Employer: Corgan / NYC Position / Job Title: Project Specialist College

Teamsters L.U. 456 Hold Session on Drug Testing Protocols for CDL Employers, Owner/Operators

ELMSFORD, NY—Teamsters Local 456 held an information session on Jan. 11 at the union’s headquarters here, entitled “Drug Testing Protocols & Procedures,” for companies with

NYC Metro Housing Costs Soar by 68% in Last Decade

ALBANY—Housing costs in New York City and the surrounding suburbs have skyrocketed by more than 68% over the last decade, the largest increase among selected

Safety Watch – Install Traffic Control Devices, Legible Control Signs At Points of Hazard During Roadwork Activities

The decision in Secretary of Labor v. Brubacher Excavating Inc. & Traffic Control Services reminds us that construction companies conducting paving and excavation operations in

Financial Management – NYC Banking on Surge in Transit-Oriented Projects

With transit-oriented development projects on the rise, the Port Authority of New York and New Jersey is also continuing its redevelopment efforts at three major

Albany Update – State Opens Applications for $325M In Grants For Clean Water Infrastructure Projects

ALBANY—New York State is making $325 million in grants available for clean water infrastructure projects through the next round of the state’s Water Infrastructure Improvement

Regeneron Buys Avon Property in Suffern; Plans $138M Spend for New R&D Complex

SUFFERN, NY—In addition to the $1.8-billion expansion Regeneron Pharmaceuticals is now advancing in Westchester County, the company announced it will invest another $138 million in

What’s New & Who’s News

A roundup of what’s new and who’s in the news both locally and in the state.

$450M Mid-Hudson Psychiatric Center To be Built with PLA for Local Trades

NEW HAMPTON, NY—The New York State Dormitory Authority said on Dec. 14 that it has released the first bid in connection with the “New Forensic

Federal Infrastructure Law’s Impacts Felt Increasingly Across America

WASHINGTON—States have committed federal funds to support more than 56,000 eligible transportation improvements in all 50 states during the last two years, spanning nearly every

New York State to Chip in $1 Billion For $10B Albany Nanotech Complex

ALBANY—New York State announced on Dec. 11 a $10-billion partnership with leaders from the semiconductor industry, including Armonk-based IBM, Micron, Applied Materials, Tokyo Electron, and

Millions of Construction Workers Are Illegally Misclassified, Costing Government, Taxpayers $22 Billion in Lost Revenues

A pernicious employment practice—called misclassification— is used by unscrupulous employers to avoid paying their share of payroll taxes and to evade certain responsibilities and liabilities

Con Edison Ends Westchester County Natural Gas Moratorium

ARMONK, NY—Natural gas hookups are coming back to Westchester County after a fourand- a-half-year pause. Con Edison is set to end the moratorium affecting most

Attorney’s Column – New Law Creates Confusion in Attempt to Clarify Substantial Completion and Maximum Retainage

In 2002, the New York State Legislature attempted to address the problem of perpetually late payments to contractors and subcontractors in the private sector by

Next Generation Leader – Taylor Reilly

Next Gen Leaders Profiles of the Industry’s New Generation Taylor Reilly Age: 23 Louis G. Nappi Scholarship received: 2018, 2019 Title & Employer: Wholesale Florist,

Albany Update – More Than 1,000 Speeding Tickets Issued In Work Zones in Hudson Valley Region

ALBANY—As construction throughout much of New York State begins to wind down with winter weather setting in, New York State officials recently highlighted the year-end

Safety Watch – Adequate Lock-Out/Tag-Out Systems Must Be In Place to Prevent Employee Injuries: OSHASafety Watch –

The decision in Secretary of Labor v. Ward Vessel & Exchange Corporation reminds us that construction companies must have adequate lock-out/ tag-out systems in place

Congressman Mike Lawler Discusses ‘Hot Topics’

ELMSFORD, NY—Congressman Mike Lawler (R-17CD) met with more than 60 members of the union Building Trades on Nov. 28 at the Teamsters Local 456 Union

Financial Management – An Update on Research and Development Credits

The availability of the Internal Revenue Section (IRC) Section 41 Research and Development (“R&D”) tax credit for construction companies stems from the recognition by the

Finally, MGM Resorts Unveils Empire City Expansion Plan

YONKERS—MGM Resorts International unveiled its vision late last month to transition Empire City Casino by MGM Resorts into a world-class entertainment destination—with the title of

Creedmore Massive Housing Plan Redo In Queens Gets Major Boost from Albany

ALBANY—The Creedmoor Community Master Plan, a massive mixed-use project to redevelop underutilized land at the 125-acre Creedmoor Psychiatric Center campus in Eastern Queens, received a

NYPA Seeks New Corporate HQ In Downtown White Plains CBD

WHITE PLAINS—The New York Power Authority is currently reviewing proposals for a brand new 250,000-square-foot Class A state-of-the-art corporate headquarters in Downtown White Plains and

State to Fund $30M for Rye Lake Filtration Plant, One of 156 Local Water Infrastructure Projects

ALBANY—In what will be the first funding awarded through the $4.2-billion “Clean Water, Clean Air, and Green Jobs Environmental Bond Act of 2022,” New York

Economic Outlook – Unpacking the U.S. Dollar’s Complicated Role As the Reserve Currency to Stabilize Markets

Unpacking the U.S. Dollar’s Complicated Role As the Reserve Currency to Stabilize Markets

The value of a nation’s currency (in this case the U.S.

South Bronx Hailed for Economic Growth Despite COVID Pandemic Challenges: Report

ALBANY—The COVID-19 pandemic hit the South Bronx especially hard, but the area’s economy has shown resiliency, according to a report released recently by New York

What’s New & Who’s News

A roundup of what’s new and who’s in the news both locally and in the state.

Albany Update – Yonkers Contracting Completes Nearly $45M Pavement Improvement Project on Section of NYS Thruway

ALBANY—New York State officials recently reported the completion of a $44.6-million pavement improvement project on the New York State Thruway I-87 in a critical corridor

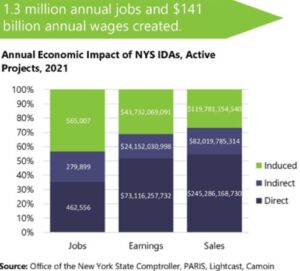

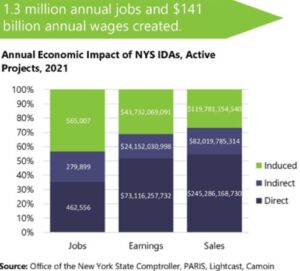

Report: New York State IDAs Generated $141 Billion In Wages; Created, Retained 1.3-Million Jobs in 2021

ALBANY—In light of some criticism being leveled against Industrial Development Agencies in New York State, particularly the need and financial returns of incentives granted to

Rockland Christens New $40-Million Complex That Houses County’s Highway Department

CHESTNUT RIDGE, NY—A project in Rockland County that has been debated, advertised for bid, withdrawn, then moth-balled and delayed for nearly six decades, has finally

Guest Viewpoint – Misclassification of Workers Undermines Fair Construction Practices, Hurts All Trades

In the cutthroat competition of the construction industry, the relationship between employers and workers can be difficult to navigate. Something as simple as how you

13th Annual CAI Seminar for P.E.s Draws Dozens to Earn 6 PDH/HSW Credits

TARRYTOWN, NY—The always-popular professional development seminar, presented annually by the Construction Advancement Institute (CAI), drew a capacity audience last month for a program entitled “ENGINEERING:

Attorney’s Column – Court: ‘Adjoining’ Properties to be Protected During Excavation Need Not Be Abutting

It has long been the law that owners and contractors who perform construction activities on a property can be held liable for damages caused to

Obituary – O.L. ‘Peter’ Bibeau

BOCA RATON, FLA—Harold Vogt, the longtime leader of The County Chamber of Commerce (now operating as The Business Council of Westchester), died on Sept. 28

Obituary – Mortimer L. Downey, III

Mortimer L. Downey III, who for 65 years was a top official and advocate for mass transit, passed away on Nov. 2 at the age

100 Years Strong – H.O. Penn Celebrates Centennial Of Challenges and Achievements

POUGHKEEPSIE, NY—H.O. Penn staged a grand gathering at its headquarters here in early September to cap off the company’s ongoing centennial celebration in business. Scores

From the Archives – H.O. Penn Meets The Challenges of 9/11

NEW YORK—Four months after the attacks that devasted lower Manhattan, Chief Executive Officer Thomas Cleveland had a newfound appreciation for his company and the employees

Soaring Road Construction Costs Threaten State and Local Projects

TARRYTOWN, NY—Highway and street materials have increased 21% since last year due to hikes in petroleum-based energy costs and other material products in addition to

Safety Watch – Tree Trimming Work Requires Documented Training, Feasible Methods to Reduce and Eliminate Harm

The recent decision in Secretary of Labor v. Asplundh Tree Expert, LLC discussed feasible and effective methods to reduce or eliminate harm to employees performing

What’s New & Who’s News

A roundup of what’s new and who’s in the news both locally and in the state.

Financial Management – Both Opportunities and Challenges for Construction Loom in the Face of Infrastructure and Resiliency

The Inflation Reduction Act’s gift of funding and new capital projects on the horizon are promising and exciting for all in our industry. However, as

Albany Update – Business Council of NYS Sounds Alarm On Impacts of State’s Energy Policies

ALBANY—The Business Council of New York State announced recently the first of several state-wide information campaigns designed to educate New York voters on the impacts

NYC Region Enters New Era of Mega Projects As Feds Appropriate $10B+ for Tunnels, Bridges

WASHINGTON—In a series of announcements in the past few days, the Biden Administration has pledged a total of $6.76 billion in federal infrastructure funding for

No Recession Looming in Construction Despite Vexing Headwinds of Inflation, Labor Shortages

TARRYTOWN—Armies of economic pundits appear mixed in their predictions about where the U.S. economy is going in 2024. Is it heading into recession or to

Latimer Proposes $474M Capital Budget

WHITE PLAINS—Westchester County Executive George Latimer and administration staff released on Oct. 17 a $473.7-million proposed 2024 Capital Budget that is highlighted by significant road

Mixed-Use $2.5-Billion Redevelopment Proposed for Galleria Mall in White Plains

WHITE PLAINS—In what is clearly the most anticipated development proposal to hit the desks of city leaders in decades, Pacific Retail Capital Partners, The Cappelli

Lt. Gov. Delgado Touts Infrastructure Projects At CIC-BCA Fall Membership Meeting Oct. 12

TARRYTOWN, NY—In the 47-year history of the Construction Industry Council, there has never been a guest speaker at an annual membership meeting quite like the

Obituary – Harold Vogt

BOCA RATON, FLA—Harold Vogt, the longtime leader of The County Chamber of Commerce (now operating as The Business Council of Westchester), died on Sept. 28

2024

2023

- Construction News January 2023

- Construction News February 2023

- Construction News March 2023

- Construction News April 2023

- Construction News May 2023

- Construction News June 2023

- Construction News July 2023

- Construction News August 2023

- Construction News September 2023

- Construction News October 2023

- Construction News November 2023

- Construction News December 2023

2022

- Construction News January 2022

- Construction News February 2022

- Construction News March 2022

- Construction News April 2022

- Construction News May 2022

- Construction News June 2022

- Construction News July 2022

- Construction News August 2022

- Construction News September 2022

- Construction News October 2022

- Construction News November 2022

- Construction News December 2022

2021

- Construction News January 2021

- Construction News February 2021

- Construction News March 2021

- Construction News April 2021

- Construction News May 2021

- Construction News June 2021

- Construction News July 2021

- Construction News August 2021

- Construction News September 2021

- Construction News October 2021

- Construction News November 2021

- Construction News December 2021

2020

- Construction News January 2020

- Construction News February 2020

- Construction News March 2020

- Construction News April 2020

- Construction News May 2020

- Construction News June 2020

- Construction News July 2020

- Construction News August 2020

- Construction News September 2020

- Construction News October 2020

- Construction News November 2020

- Construction News December 2020

NYCDEP Begins Final Phase of $2 Billion Delaware Aqueduct Bypass Tunnel Repairs

NEW YORK – New York City loses millions of gallons of water each day from leaks in the Delaware Aqueduct Tunnel upstate, the equivalent of

NYPA Trustees Approve Moving Forward On New Corporate HQ in White Plains

WHITE PLAINS—The New York Power Authority Board of Trustees approved a request on Oct. 8 authorizing staff to negotiate a binding development agreement with the

NYSDOT Report: Route 17 Expansion Alternatives To be Studied Will Cost More Than $1.3B Each

ALBANY—A review of the 132-page “Scoping Report” for the “NYS Route 17 Mobility and Access Improvements Project” also known as the Route 17 expansion project,

New York City Update – MTA Commits to $7.5 Billion in Capital Plan Contract Awards to MWBE/DBE/SDVOB Firms

NEW YORK—The Metropolitan Transportation Authority announced Sept. 30 its commitment to award a historic amount to historically underutilized businesses as part of its recently announced

U.S. Construction Jobs Swell By 25,000 in September

WASHINGTON— Construction sector employment rose by 25,000 jobs in September as both nonresidential and residential contractors added workers at a faster clip than other industries,

Attorney’s Column – Court Directs Parties to Arbitration Despite the Lack of a Signed Agreement

When most disputes come to a head, the battle cry is “I’ll see you in court!” In connection with construction disputes, that battle cry often

Con Edison Begins Construction on $1.2B Project To Support Electrification of JFK Airport, MTA Buses

NEW YORK—On Oct. 1, Con Edison marked the start of construction of its Reliable Clean City – Idlewild Project, which will support the electrification of

What Does New York State’s Deregulation Of Marijuana Mean for the Workplace?

In general, the deregulation of marijuana has led to implications on drug testing policies and employee rights. Employers should consider removing THC from their pre-employment

Economic Outlook – What are the Short-Term Economic Policy Impacts of U.S. Presidential Elections?

The period leading up to a U.S. presidential election is often characterized by significant uncertainty and market volatility. As candidates run for office, investors, businesses

Making a Career of it

Six years ago, Rob Tirella got a phone call from a friend, a member of Laborers 235, offering him the opportunity to join a union.

Montefiore Health Plans $41M Expansion, Modernization at Mount Vernon Hospital

MOUNT VERNON—Montefiore Health System officials unveiled late last month what they termed transformative plans for Montefiore Mount Vernon Hospital designed to meet the community’s healthcare

Financial Management – Preparing for the Election: Let’s Compare Tax Proposals of Candidates Harris and Trump

The 2024 presidential election presents a pivotal moment for the construction industry. Both Vice President Kamala Harris and former President Donald Trump propose contrasting tax

City of Newburgh Completes $32-Million North Interceptor Sewer Improvement Job

NEWBURGH, NY—New York State, City of Newburgh and environmental activists gathered on Oct. 8 to celebrate the completion of the $32-million North Interceptor Sewer Improvement

Safety Watch – Contractors Beware: OSHA Can Cite You For the Work and Actions of Your Subs

The realities and complexities of modern-day construction make it likely that a contractor will use subcontractors to perform a portion of those activities and their

The Top in-Demand Jobs In Building, Construction

Construction activity serves many masters, both as a leading economic indicator of what is occurring and as a cornerstone of economic development for what lies

Future of NY Transportation Hangs in the Balance As MTA Faces Ways to Plug Massive Funding Gap

ALBANY—As it prepares to submit its 2025-2029 Capital Program, the Metropolitan Transportation Authority must find billions in new funds even as the state tries to

Building Trades Leaders Are Optimistic Robust Volume Will Sustain Thru 2025

TARRYTOWN—As the nation enters the final stretch of the Presidential campaign season, jobs are on the minds and lips of everyone. And the jobs that

ECCO III Completes Major Rebuilding Project Of Storm King Highway Ravaged by Flooding

HIGHLAND, NY—State Route 218 in the Town of Highlands in Orange County has reopened to traffic for the first time since devastating floods in July

Contractors, Unions Boost Awareness Of Industry’s Problems, Suicide Rates

ALBANY—As National Suicide Prevention Month continues through September, experts are urging companies to cultivate a stronger “culture of care” to support their crews and staffers.

Attorney’s Column – Performance Bond is Not an Insurance Policy For Later Claims Brought for a Contract Breach

Performance bonds are a familiar tool in the construction industry – particularly on public works and larger private projects. Their purpose is to provide an

U.S. Supreme Court Justice Sonia Sotomayor Cuts Ribbon on New School Named in Her Honor

YONKERS, NY—U.S. Supreme Court Justice Sonia Sotomayor arrived here in mid-September to celebrate the opening of the Yonkers Public School District’s newly constructed school named

Should Congestion Pricing Go Before Voters? Gov. Hochul’s Lawyers Want Issue on Ballot

ALBANY—In public, Gov. Kathy

Hochul has repeatedly said her order to

pause congestion pricing was motivated

by economics, not politics. But behind<br

Albany Update – Sloatsburg Service Area on Thruway Reopens

ALBANY—The New York State Thruway Authority announced on Sept. 10 the reopening of the newly renovated Sloatsburg Service Area located on I-87 northbound between exit

Bill Now Requires GCs, Subs to Submit Payrolls to Certified Electronic Database

NEW YORK—In advance of the New York City Labor Day Parade, on Sept. 7, New York Gov. Kathy Hochul signed eight pieces of legislation aimed

MTA Proposes $68.4B Capital Program; Viable Funding Sources in Question

NEW YORK— The Metropolitan Transportation Authority released its proposed 2025-2029 Capital Plan on Sept. 18, outlining a $68.4-billion investment in the region’s subways, buses, railroads,

Obituary – Anthony Cellini

MONTICELLO, NY–The veteran Sullivan County politician and businessman Anthony “Tony” Cellini passed away on Sept. 6 at the age of 83.

Financial Management – Employee Retention Credit Processing Updates: Here’s What Construction Firms Need to Know

Did you apply for the Employee Retention Credit over the last few years only to face daunting delays? ERCs were a refundable tax credit introduced

City Voters Delivered $4.2B Green Bond Act; But Funding Formulas Steer Dollars Upstate

NEW YORK— Expecting to see green, New York City officials are seeing red instead.

Approved by voters statewide in 2022, the Clean Water, Clean

Feds to Provide $3.8M to Help Build IBEW Offshore Wind Training Facility

WASHINGTON—As employment opportunities in the sustainable energy sector advance, elected officials representing New York State announced $3,828,000 in federal funding for the Educational and Cultural

America’s Bridge Repair Campaign Witnesses Slow & Steady Gains as ‘Poor’ Spans Decline

WASHINGTON—Nearly 221,800 U.S. bridges need major repair or replacement, a major national construction trade association reported following an analysis of recently released federal government data

State Certifies 31 New Climate Smart Communities

ALBANY—The latest round of communities to achieve certification as part of New York State’s Climate Smart Communities Certification program, which supports local efforts to meet

NYC Opens 24 New School Buildings In Advance of 2024-2025 School Year

NEW YORK – New York City announced on Sept. 4 the completion and opening of 24 new school buildings, including 11,010 new seats, across the

600 Hudson Valley Students Eager to Explore Careers In the Building Trades at 24th Annual Expo in 2025

SUFFERN, NY– Planning is underway to welcome more than 600 local high school students who will meet with experts in the Building & Construction Trades

Safety Watch – Firm’s Well-Crafted Safety Plan Proved Worthless, Leading to OSHA Fine for Willful Repeated Risk

Although the decision of Secretary of Labor v. Trinity Solar, LLC specifically pertains both to the use of hard hats and fall arrest systems necessary

CIC Softball Reunion Scores Big For Ukrainian Humanitarian Relief

TARRYTOWN, NY—With a final score that was more indicative of football game than a softball contest, the annual CIC Softball Classic was tied after six

Washington Update – FAA to Allocate $59 Million For Upgrades at 26 NY Airports

WASHINGTON—U.S. Senate Majority Leader Charles E. Schumer and U.S. Sen. Kirsten Gillibrand announced on Sept. 4 that $59,115,204 in federal funding has been allocated to

What’s New & Who’s News

A roundup of what’s new and who’s in the news both locally and in the state.

PJS Montesano JV Begins Work On $1.9B Kensico Water Tunnel

VALHALLA, NY—In late July, officials of the New York City Department of Environmental Protection, local officials in Westchester and construction professionals threw the ceremonial “first

Turner Begins Work on $220M Expansion At Westchester Medical Center Project

VALHALLA, NY—New York State Lt. Governor Antonio Delgado was among the many dignitaries that joined Westchester Medical Center Health Network’s leadership on July 24 to

Ossining Breaks Ground on Record $100-Million Water Treatment Plant

OSSINING, NY—A host of elected officials celebrated the official groundbreaking for the new Indian Brook Water Treatment Plant—the largest infrastructure project in Ossining’s history. It

COMMENTARY – Stuck Bridges, Buckling Roads Sound Alarms That America’s Aging Infrastructure is in Distress

WASHINGTON—More than $450 billion in infrastructure spending has already been awarded to states and cities through the Infrastructure Investment and Jobs Act passed in 2021.

MTA Advisory Committee Slams Congestion Pricing Alternatives

NEW YORK—The Permanent Citizen’s Advisory Committee to the MTA released a new report earlier this month entitled “Funding the MTA’s 2020-2024 Capital Plan: Evaluating Proposed

Halmar Int. Completes Major Construction On U.S. Rte. 1 Bridge Over Mamaroneck River

MAMARONECK, NY — New York State officials announced on Aug. 2 that major construction was completed on a project that reconstructed the bridge carrying U.S.

Attorney’s Column – Ambiguous Contract Sends Dispute to Trial And Prevents Summary Resolution of Claim

This column often stresses the important provisions to include in construction contracts. Among them are thorough indemnification clauses, dispute resolution provisions and adequate insurance provisions.

Economic Outlook – NYC Metro Commercial Real Estate Sector Improving Marginally So Far This Year

As of mid-2024 most reports of the U.S. economy were positive, despite geopolitical uncertainty, lower inflation, the prospect of interest rate cuts, and continued employment

New York City Council Approves Bronx Re-Zoning; Adams Admin. Commits to $500M in Improvements

NEW YORK—On Tuesday (Aug. 6) the New York City Council’s Committee on Land Use voted to approve the Bronx Metro-North Station Area Study rezoning proposal

Albany Update – Funding Will Allow Second Ave. Subway Project to Continue

ALBANY—New York Gov. Kathy Hochul announced on Tuesday (July 30) that the state will provide $54 million to support utility work that will allow the

Construction Advancement Institute Awards $70,000 in Academic Grants to 14 Students

Construction Advancement Institute Awards $70,000 in Academic Grants to 14 Students August 20, 2024 TARRYTOWN, NY—As part of its mission to elevate professionalism in the

Darante Construction, Ltd.

Now in its second generation as a thriving mason contracting enterprise, Darante Construction, Ltd. was established in 1986 by the late Genesio Fante who found

Hunter Roberts Prismatic JV Named Low Bidder On $326M Mid-Hudson Forensic Hospital Project

ALBANY—The New York State Dormitory Authority opened bids on the General Construction component of the Mid-Hudson Forensic Hospital project in New Hampton, NY on Aug.

300 Munis Seek Pro-Housing Certification To Tap Into $650 Million in State Funding

EAST HAMPTON, NY—New York Gov. Kathy Hochul announced on Aug. 9 that 335 New York municipalities have launched applications to be certified as Pro-Housing Communities,

15 Students Share $75,000 in College Scholarships From CIC/Louis G. Nappi Management-Labor Fund

TARRYTOWN, NY— Fifteen college and graduate students will begin the new academic year each with a $5,000 grant from the Louis G. Nappi Construction Labor-Management

Financial Management – The Financial Impact of Project Delays: Prevention and Mitigation Strategies

In this post-COVID era, the construction industry grapples with unpredictable project delays that can severely affect the profitability of a job and the company. Despite

Safety Watch – Risk of Cave-Ins, Trench Collapses Pose Significant Perils and Fines for Contractor

Over the past decade, at least 250 workers have died from cave-in or trench collapses. Because of the significant peril that can result from these

What’s New & Who’s News

A roundup of what’s new and who’s in the news both locally and in the state.

Washington Update – ARTBA Chair Testifies that a Maze of Policy Changes May Complicate IIJA Implementation

WASHINGTON—While more than 75,000 transportation improvement projects have been initiated, including one in nearly every congressional district, and 43,000 construction jobs have been created by

NYC Office Building Market Sees Values Rise Amid Shift in Demand for Space

NEW YORK—Office buildings in New York City remain a critical contributor to its economy and tax base, as market values reached nearly $205 billion in

Port Authority Sees $24M Funding For Stewart Runway Project in 2017

NEW YORK—The Port Authority of New York and New Jersey announced on Aug. 12 that New York Stewart International Airport had received a $24.2-million grant

MTA to Defer $16.5 Billion In Capital Projects, Repairs

NEW YORK—The fallout from the decision by New York Gov. Kathy Hochul last month to put the New York City congestion pricing tolling program on

Gateway Tunnel Job Taps Final $6.8B in Fed Funds

NEW YORK—Federal and state officials joined the Gateway Development Commission, Amtrak and NJ Transit executives to announce the final federal funding in place for the

Yonkers Contracting Begins Major Projects To Replace Bronx Bridges, Valued at $517M

ALBANY—New York State officials announced late last month the start of a $517.5-million project to replace two bridges along the Bronx River Parkway between East

Gov. Hochul Meets with Local 825 Leaders, Reaffirms Commitment to Infrastructure

NEW HAMPTON, NY—The International Union of Operating Engineers Local 825 (IUOE) hosted Gov. Kathy Hochul at its New York Training Center on July 10 to

Countdown Begins for Selecting A Downstate Casino Gaming Site

ALBANY—The New York State Gaming Facility Location Board recently unanimously approved an updated timeline for the Request for Applications for downstate commercial casino licenses, commencing

Obituary – Francis X. McArdle

DANVER, MA—New York State lost a true icon of construction industry leadership earlier this year when longtime association executive and advocate Francis X. McArdle, former

OSHA Releases Proposed New Regulation On Heat Injury, Illness Prevention Rule

WASHINGTON—The Occupational Safety and Health Administration has released a proposed rule intended to reduce heat injuries, illnesses, and deaths. Excessive heat exposure has been identified

Attorney’s Column – Appellate Court: ‘Paperwork Breach’ Dooms Claim

While most contractors strive for excellence in their construction—after all, it’s the product of their ingenuity and know how that will potentially be around for

NYC Reaches $112.4B Budget Accord With $2B to Build Affordable Housing

NEW YORK—With negotiations extending down to the wire, New York City Mayor Eric Adams and the New York City Council agreed on a new $112.4

Bear Mountain Bridge Marks Centennial With Festivities Spanning Many Interests

HIGHLAND, NY—The countdown has begun in celebration of the 100th anniversary of the venerable Bear Mountain Bridge, the Hudson River’s first vehicular crossing south of

New Rochelle to Spend $10M on Flood Mitigation To Upgrade Aging Stormwater Infrastructure

NEW ROCHELLE, NY—The City of New Rochelle announced recently the launch of the first flood mitigation project as part of its $10-million investment into the

Albany Update – More than $33M in Road Work Begins in Westchester County

ALBANY—Work has begun on infrastructure projects in the lower Hudson Valley that will promote resiliency along key corridors in Westchester County.

CIC Golf Classic Staged At Sleepy Hollow Country Club

SCARBOROUGH, NY—There were 188 spirited golfers who took on high temperatures and the legendary Sleepy Hollow Country Club on Mon., July 8, for a day

Next Generation Leader – Pat Fortunato

Next Gen Leaders Profiles of the Industry’s New Generation Pat Fortunato Age: 25 Current Employer: JPMorgan Chase Position / Job Title: Software Engineer University and

Financial Management – High-Impact Legislation, Innovation and Resolve Are Drivers for Challenging Construction Season

Despite the challenges of inflation and economic uncertainties, the buoyant construction industry is poised for an interesting second half of 2024. Impactful legislation, innovative practices,

What’s New & Who’s News

A roundup of what’s new and who’s in the news both locally and in the state.

Safety Watch – Avoid Perils During Loading And Stacking Operations

During loading and stacking operations, coordination between the operators of powered industrial vehicles and their spotters is necessary in cases of instability hazards to avoid

Firm Picked to Redevelop Downstate Correctional In Dutchess with Mixed-Use, Community Space

FISHKILL, NY—In stark contrast to the prison it once was, the repurposed correctional facility here is hoping to see lots of people come and go

Port Auth. Signs Two Hangar Leases At Stewart Valued at $119 Million

NEW WINDSOR—The Board of Commissioners for the Port Authority of New York and New Jersey approved two new corporate hangar leases at New York Stewart

MTA Sees Projects on the Chopping Block, Due to Gov’s Congestion Pricing ‘Pause’

NEW YORK—How will the MTA plug the day-to-day operating funds to offset the loss of $15 billion in bond funding, which the agency had planned

Westchester Joint Water Works Seeks Filtration Plant Bid by Late 2024

MAMARONECK, NY—The Westchester Joint Water Works has recently entered into a consent decree with the U.S. Environmental Protection Agency and the New York State Department

Showcase Unionism

The Greater Hudson Valley BSA Council visited the Operating Engineers Local 137 training center in Montrose, NY on Sat., June 15, to explore what it

State Awards $67M to Seed Development Of 2,400 New Homes in Mid-Hudson Region

HYDE PARK, NY—State officials last month unveiled the first 13 awards totaling $67 million under the Mid-Hudson Momentum Fund, a $150-million initiative geared to increasing

State EFC Approves $120M in Funding For Local Water Infrastructure Projects

ALBANY—The New York State Environmental Facilities Corporation Board of Directors recently approved more than $120 million in financial assistance for water infrastructure improvement projects across

Attorney’s Column – Court: Not All ‘Incorporated’ Provisions Of an Upstream Contract Flow to the Sub

This column has often written about issues that affect contractor/subcontractor relations because subcontracting is ubiquitous in the industry. One of the most important aspects of

New York State Maps Out 21 DRI, NY Forward Projects in Four Hudson Valley Communities

ALBANY—New York named 21 transformational projects for the Mid-Hudson region as part of two economic development programs: the Downtown Revitalization Initiative and NY Forward.

Economic Outlook – War in Ukraine Exacerbating Global Economic Volatility

The war in Ukraine has profoundly impacted the global economy, with ripple effects extending far beyond its borders. This conflict originally disrupted vital energy supplies,

Jorrey Excavating Inc

Jorrey Excavation Inc, a certified women-owned business, provides timely excavation and milling/scarifying services for a variety of clients with public works projects.

Congestion Pricing – Pros & Cons

TARRYTOWN, NY—When it comes to problem solving, New Yorkers can be like a large family that finds new ways to fight over the very things

67th Annual BCA Golf Outing Draws 75 Golfers, 105 Dinner Guests

WHITE PLAINS, NY—The Starter’s sheet of tee-times was brimming with more than 19 golf foursomes who entered the 2024 BCA Golf Outing here at Westchester

Financial Management – Key Strategies Contractors Can Employ In Periods of Elevated Interest Rates

Interest rate changes directly impact construction companies in a variety of ways, beginning with the affordability of borrowing and availability of financing. To battle these

Next Generation Leader – Anthony Sanseverino

Next Gen Leaders Profiles of the Industry’s New Generation Anthony Sanseverino Age: 23 SUMMARY: Anthony’s dream of becoming an engineer began in high school, when

Safety Watch – Internal Traffic Control Plans Offer Protections To Work Zone Crews During Paving Operations

With their constant movement of heavy equipment and workers on foot, road paving operations are dynamic worksites that can experience struck-by hazards if crew members

What’s New & Who’s News

A roundup of what’s new and who’s in the news both locally and in the state.

NYCHA Signs 2024 PLA with Building Trades

NEW YORK – The New York City Housing Authority announced on Feb. 29 the signing of the 2024 Project Labor Agreement (PLA) with the Building

Flat FY2025 State Budget for Roads Underscores Needs for Transportation

SLEEPY HOLLOW, NY—Despite widespread support from regional lawmakers to add millions of dollars to the FY2025 state budget for Hudson Valley roads and bridges, the

GWB $2B Rehab Passes Halfway Mark

NEW YORK—After nine decades of standing tall and serving as the most important piece of transportation infrastructure in the nation, the George Washington Bridge is

Route 17 Expansion Project Details Posted in Federal Register Filing

TOWN OF WALLKILL, NY—In advance of two public scoping sessions this month on improvements or expansion possibilities for Route 17 through Orange and Sullivan counties,

Regional Roundup – MTA Completes Multi-Year Metro North Croton Harmon Yard Maintenance Project

CROTON-ON-HUDSON, NY—Major upgrades to MTA Metro-North Railroad’s vital maintenance and operations hub at Croton-on-Hudson, NY, which employs 1,200 people, was announced earlier this month.

Congestion Pricing Delays Put $9B In 2024 MTA Capital Projects at Risk

ALBANY—New York State helped stabilize the MTA’s finances last year, but its capital program for maintaining and upgrading the regional transit system faces significant delays

NYS Thruway Worker Killed; Another Seriously Injured

ALBANY—Just weeks after recognizing Work Zone Awareness Week in New York State (April 15-19), an accident at an upstate work site claimed the life of

Attorney’s Column – Court: For Work Where a License is Required, One is Needed to Recover in Event of a Claim

The ostensible purpose of contractor licensing statutes is to ensure that the public’s health and welfare is protected by permitting only qualified contractors to work

Peckham Centennial Celebration

Great ideas in business are often hatched at kitchen tables. A century ago, on March 17, 1924, William H. Peckham, Jr., along with his father-in-law