No Recession Looming in Construction Despite Vexing Headwinds of Inflation, Labor Shortages

By JOHN JORDAN – October 24, 2023

TARRYTOWN—Armies of economic pundits appear mixed in their predictions about where the U.S. economy is going in 2024. Is it heading into recession or to a soft landing? But they’re in lockstep that the construction sector will continue to be a beacon of profitability and job creation over the coming year. Look elsewhere if you’re looking for a recession.

In a recently released quarterly survey conducted by the Wall Street Journal, business and academic economists lowered the probability of a recession within the next year, from 54% on average in July to a more optimistic 48%. That is the first time they have put the probability below 50% since the middle of last year.

While those figures cannot be characterized as anything but mixed, New York City/Hudson Valley construction industry executives are in agreement that the construction and building sectors will continue to fare well in 2024, despite international, national and local headwinds, including the war in Gaza, high interest rates, inflation, a troubled housing market and labor shortages in many industries.

Gus Scacco, Chief Investment Officer and CEO of Goshen, NY-based Hudson Valley Investment Advisors, Inc., during a recent webinar, pointed to the construction sector as one reason why the nation will not enter a recession in 2024.

“We’ve been hearing about how we are going into a recession for over a year, and the data does not support that,” Mr. Scacco said. “Here are the reasons why: construction, as well as consumer activity, is very strong; the GDP continues to power ahead; inflation is coming down substantially; interest rates are calming; supply-chain levels have normalized; housing prices have come down nationally, although not in the Northeast; wages, job openings and quit rates are trending lower, which provides more stability to employers; and small businesses are feeling a lot better.”

He added, “Unless there’s some sort of a shock, we’re not having a recession in the next six months, and we’re positively optimistic about the first half of 2024.”

The region’s construction sectors have been bolstered by significant federal funding, as well as state infrastructure and environmental financing. Particularly in the lower Hudson Valley, organized labor and union contractors have been frustrated by their lack of participation in the burgeoning multifamily residential construction sector in major Westchester cities, despite many of these projects securing either local or county Industrial Development tax incentives.

John T. Cooney Jr., Executive Director, Construction Industry Council of Westchester & Hudson Valley, Inc. and Alan Seidman, Executive Director, Construction Contractors Association of the Hudson Valley both noted that the construction industry has posted strong results in 2023 and prospects are good that 2024 will be a repeat. Mr. Cooney and Mr. Seidman were also panelists on the webinar sponsored by Orange Bank & Trust Co.

“The state of the construction industry can be described as robust, and its stimulus is essentially driven by immense growth in commercial and health care-focused development, increased federal investment such as the Infrastructure Investment and Jobs Act (IIJA), and municipal spending supported by the American Rescue Plan Act (ARPA),” said Mr. Cooney. “(Construction) companies have met this increased demand by investing in new and more productive equipment, but also by investing in workforce development for existing employees, and leading efforts to attract a new and more diverse workforce.”

Mr. Cooney noted that the attraction of new construction workers in the region has come from “a much larger and stronger move to diversity in the workforce.” He said the industry is drawing these new workers from other low-paying industries.

“Essentially for the construction industry, if the individual has the will our partners in labor and companies themselves can build the skills,” he said, for these low-skilled workers to begin a much better paying career in the construction industry.

Mr. Cooney concluded by saying that the region’s construction industry has a healthy backlog of work for the next four to five years. Some challenges going forward include high construction material costs, high inflation and bureaucracy that threatens to hold up projects from going out to bid.

“There is plenty of work to keep the construction sector active for the foreseeable future,” said Mr. Seidman when speaking of the Mid-Hudson region “There is a large state project starting in early 2024 in New Hampton, and also new development and improvements happening at West Point. Unfortunately, we are also seeing an exodus of businesses and people leaving New York, many citing high taxes and unfriendly regulatory environments, and we have to be mindful of those negative trends also impacting the economy.”

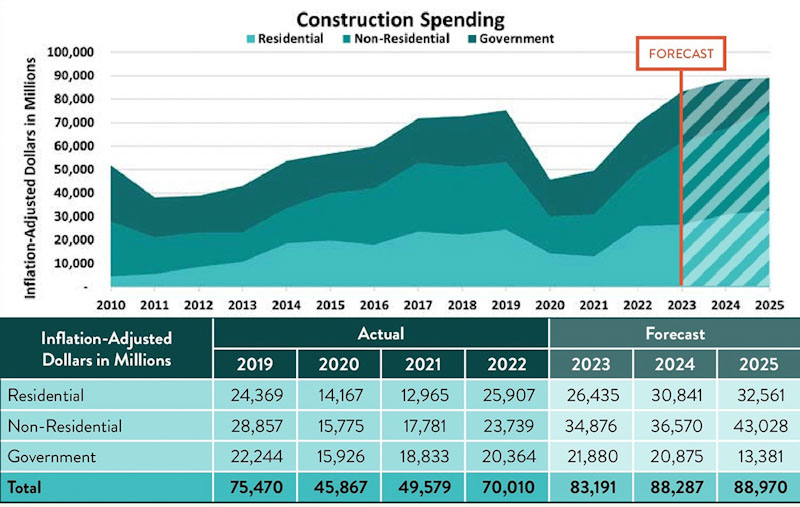

Report: NYC Construction Spending to Reach $83 Billion in 2023

The New York Building Congress released its “2023-2025 New York City Construction Outlook Report” on Oct. 18 where it projects that total construction spending in New York City will reach $83 billion in 2023, up $13 billion from last year, adjusting for inflation. The updated spending figure is projected to reach $261 billion over a three-year period and is about 18% higher than pre-pandemic spending.

The report stated, “Spending in inflation-adjusted dollars is expected to reach $261 billion ($285 billion, in nominal dollars) over a three-year period, growing to $88 billion in 2024 and then to $89 billion in 2025. Compared to the pre-pandemic, three-year period from 2017 to 2019, this reflects an inflation-adjusted increase of $40 billion. Although high interest rates on construction starts and property mortgages are expected to somewhat depress property values through reduced demand, escalating material and labor costs—as well as ongoing supply chain issues—have significantly contributed to increased building costs and are not likely to deflate with more development.”

“Construction spending has always served as an indicator of a region’s economic health, and we’re proud to report continued growth and resilience, high levels of employment and billions of dollars in economic outputs across New York City,” said Carlo A. Scissura, President and CEO of the NY Building Congress.

He added, “Notably, residential construction has declined citywide due to the expiration of 421-a, high interest rates and outdated bureaucratic red tape. The Building Congress calls for policies to support housing production at all levels of affordability to combat our housing shortage and ensure New York is a functional and affordable place for all New Yorkers.”

Non-residential development continues to lead construction spending, totaling $34.9 billion in 2023. In 2023, 6.65 million square feet of new office space will be completed. New office construction is expected to decline by a million square feet each year through 2025. Non-residential construction will likely be driven by manufacturing and educational projects and laboratories in New York City over the next several years, the report stated.

Over the next few years, government spending on infrastructure development is projected to dominate the market. In 2023, government construction spending will reach $22 billion, up from $20 billion in 2022. While funding decisions are still being made at the federal level for competitive grants from the Infrastructure Investment and Jobs Act (IIJA), formula funding is expected to reach New York City much more rapidly, according to the report.

The Metropolitan Transportation Authority is expected to invest $30 billion within the five boroughs over the next three years, a 47% increase over pre-pandemic total spending between 2017 and 2019. The Port Authority of New York and New Jersey is expected to invest $1.8 billion in New York City capital projects in 2023, slightly down from almost $2 billion in 2022. An additional $1.6 billion in public works spending will be undertaken by various state and federal agencies in 2023, the New York Building Congress stated.

One of the few negatives for the construction industry in New York City was the impact of the 421a tax incentive’s expiration on new multifamily building projects. Residential development and rehabilitation accounts for 32% of construction spending in 2023, down from 37% in the previous year. Due to the expiration of 421-a, combined with high interest rates and significant bureaucratic hurdles, property owners and investors are expected to prioritize spending on maintaining, renovating, and upgrading existing residential properties over building new ones over the next few years, according to the report.

Another bright spot for the city’s construction sector is the fact that its workforce is almost back to pre-pandemic levels. The report noted that construction employment in 2023 is behind its pre-pandemic levels by 5%. However, the building industry is set to grow by almost 19,000 new jobs within three years. The Building Congress anticipates employment in the construction of buildings, heavy and civil engineering, and specialty trades to total 153,000 jobs in 2023, 160,000 in 2024 and 162,000 in 2025, when the industry is expected to finally bounce back to pre-pandemic employment levels.

A prominent construction industry executive also pointed out the industry’s resilience during the COVID pandemic and its promising future.

“While the commercial real estate development and construction industries in New York City are facing significant headwinds due to the economic climate, we remain bullish about the long-term growth and success of our industry,” said Ralph J. Esposito, Chair of the New York Building Congress and President of the Northeast and Mid-Atlantic Region at Suffolk. “The federal government’s heavy investment in infrastructure, along with resilient sectors such as healthcare, life sciences, manufacturing, data centers and transportation, will continue to create opportunities to develop and build incredible projects that will transform our city skyline and improve the quality of life for our citizens.”