Commercial, Multifamily Starts in NYC Down 31%

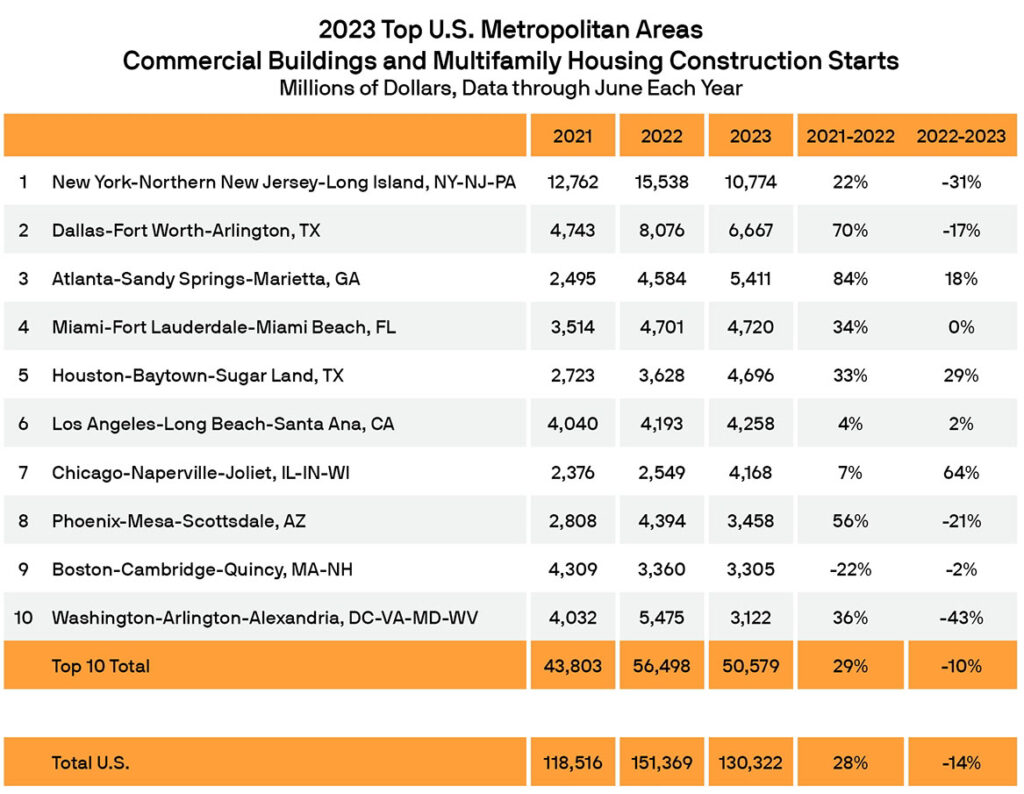

HAMILTON, NJ—Recently released new data from Dodge Construction Network found that the value of commercial and multifamily construction starts across the top 10 metropolitan areas of the U.S. fell 10% in the first half of 2023, relative to that of 2022. Nationally, commercial and multifamily construction starts fell 14% on a year-to-date basis through June.

Commercial and multifamily construction has suffered thus far into 2023 as tighter lending standards, higher interest rates, slowing demand and societal changes, such as continued remote work, impact the sector.

In the first half of 2023, the New York metropolitan area was the top market for commercial and multifamily starts at $10.8 billion, but suffered a 31% decrease from the first six months of 2022. In second was the Dallas, TX, metropolitan area, totaling $6.7 billion in the first half of 2023, a 17% decline. The Atlanta, GA, metro area ranked third with $5.4 billion in starts—an 18% gain over 2022 on a year-to-date basis.

The remaining top 10 metropolitan areas through the first half of 2023 were:

- Miami, FL, flat ($4.7 billion)

- Houston, TX, up 29%

($4.7 billion) - Los Angeles, CA up 2%

($4.3 billion) - Chicago, IL, up 64%

($4.2 billion) - Phoenix, AZ, down 21%

($3.5 billion) - Boston, MA, down 2%

($3.3 billion) - Washington, D.C., down 43% ($3.1 billion).

The top 10 metropolitan areas accounted for 39% of all commercial and multifamily starts in the United States in the first half of 2023, up from 37% in that of 2022.

Commercial and multifamily starts are comprised of office buildings, stores, hotels, warehouses, commercial garages and multifamily housing. Not included in this ranking are institutional projects (e.g., educational facilities, hospitals, convention centers, casinos, transportation terminals), manufacturing buildings, single family housing, public works and electric utilities/gas plants.

In total, U.S. commercial and multifamily building starts fell 14% to $130 billion on a year-to-date basis through six months. Multifamily starts lost 17%, declining to $61 billion, and commercial starts fell 11% to $70 billion. In the first half of 2023, across the top 10 metro areas, commercial building starts rose 1% to $27 billion, while multifamily starts fell 21% to $24 billion.

“The wind has gone out of the sails for the commercial and multifamily sectors,” stated Richard Branch, chief economist for Dodge Construction Network. “Starts are likely to worsen still in the second half of the year, as interest rates head even higher. Tighter financial conditions and significant market shifts have led to precipitous declines in starts across many metropolitan areas. However, even as markets begin to recover next year, significant structural change in the sector could lead to a tepid recovery with levels well below what was seen before the pandemic.”

In the New York metropolitan area, multifamily starts were down 39% in the first half of 2023 following a robust first half of last year, with the largest multifamily projects to break ground being the $500-million 7112 Park Ave project and the $414-million North Cove mixed-use building. At the same time, commercial starts fell 11% due to a pullback in parking structures and retail, offsetting gains in hotel, warehouse and office construction. The largest commercial projects to get started in the first half of 2023 were the $100-million Rolex headquarters and the $94-million College Point Logistics Center.