States Pass 24 Legislative Measures in 2023 To Increase New Transportation Investment

By CAROLYN KRAMER SIMONS – July 21, 2023

WASHINGTON—From general fund transfers to electric vehicle (EV) registration fees, 2023 has turned out to be a busy year for state transportation funding advocates. As of mid May, states approved 24 measures for a combined $13.5 billion in new transportation revenue. Several other states are also considering bills to increase their transportation investment.

One of the most significant pieces of legislation was signed into law by Minnesota Gov. Tim Walz (DFL) May 24. The plan institutes a new retail delivery fee (50 cents per delivery of $100 or more, with exceptions), raises the metro sales tax for transit funding, increases the motor vehicle sales tax, and indexes the gas tax to inflation (Minnesota Highway Construction Cost Index, offset by removing the minimum markup on gasoline). The package also includes several one-time funding provisions, and in total is expected to generate $1.3 billion over the next two years.

Other notable measures approved this year:

- Florida: $4 billion

general fund transfer - Hawaii: New EV road

usage charge - Missouri: $2.8 billion general fund revenue

and bonds for I-70 - Indiana: Three-year

continuation of gas-tax

indexing (no more than

1 cent per year) - Montana: New EV

registration fee - Texas: New EV

registration fee - Georgia: Tax on EV

charging sales - Montana: Tax on EV

charging sales - Utah: Tax on EV

charging sales - Tennessee: $3.3 billion

general fund transfer

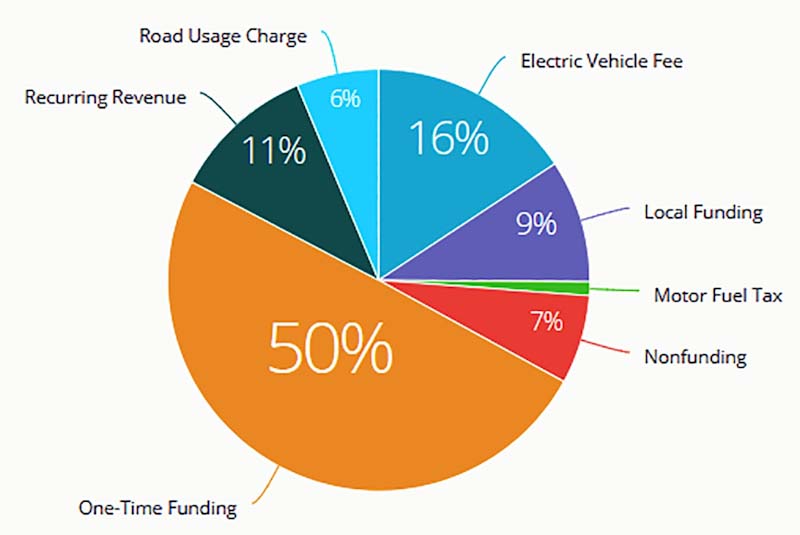

Half the bills passed are one-time funding measures of all bills introduced this session (111 bills) as states tap surplus general funds, COVID relief revenue, and bonds to meet federal matches and jumpstart projects.

Recurring revenue models have taken several forms, but legislation to implement or increase EV fees—including charging fees and registration fees—is the second most popular category explored by state legislatures. They represent 35 bills (16% of 2023 transportation funding legislation) introduced in the first five months of this year, a sizable increase when compared to the eight bills tracked in the previous year.

Willingness among lawmakers to pass transportation funding measures and explore new revenue models is growing as states seek to diversify revenue streams. In many cases, new revenue helps states meet federal match requirements and become eligible for potential grant opportunities.

For the latest updates on transportation development matters, visit the ARTBA Transportation Investment Advocacy Center (TIAC) at: transportationinvestment.org. ARTBA’s state legislative dashboard tracks funding measures as they move through the legislative process, and the ARTBA blog provides additional context on state and local initiatives.

The Construction Industry Council of Westchester & Hudson Valley, Inc., is the New York State affiliate chapter of ARTBA.

About the author: Carolyn Kramer Simons is ARTBA’s senior director, state funding policy, and managing director of its Transportation Officials Division. She can be reached at [email protected]