Future of NY Transportation Hangs in the Balance As MTA Faces Ways to Plug Massive Funding Gap

ALBANY—As it prepares to submit its 2025-2029 Capital Program, the Metropolitan Transportation Authority must find billions in new funds even as the state tries to resolve the $15-billion shortfall in revenue created by the pause on congestion pricing.

In a report released on Sept. 12, New York State Comptroller Thomas P. DiNapoli laid out the possible sources to fund the MTA’s substantial capital needs and emphasized areas of capital work expected to receive funding in its next capital program.

“The choices that the MTA and the state make in the coming months will determine the future of the transportation system for years to come,” Mr. DiNapoli said. “Understanding the options and what’s at stake is key for all stakeholders and riders in particular. It’s my hope that this report will help underscore the priorities and the challenges the MTA faces in paying for the upcoming capital program.”

Without congestion pricing in its 2025-2029 capital program, the MTA budget gap could reach $27 billion, Bloomberg reports.

New York’s Public Authorities Law requires the MTA to submit its capital program for approval by the state capital program review board by Oct.1. The MTA has more control over its capital funding needs by choosing which project it prioritizes, but significantly less control over its funding beyond raising fares and tolls for increased borrowing. The MTA has an overwhelming list of capital needs, but paying for them has been made more difficult by the loss of billions in revenue it had anticipated would fund its previous $54.8 billion 2020-2024 capital program. Projects that it cannot fund, such as Phase 2 of the Second Avenue Subway, could be carried over into the 2025-2029 program, crowding out other investments. Setting priorities for the next capital program and being transparent about how and why they were chosen will be key for stakeholders, especially the riders the MTA is trying to win back.

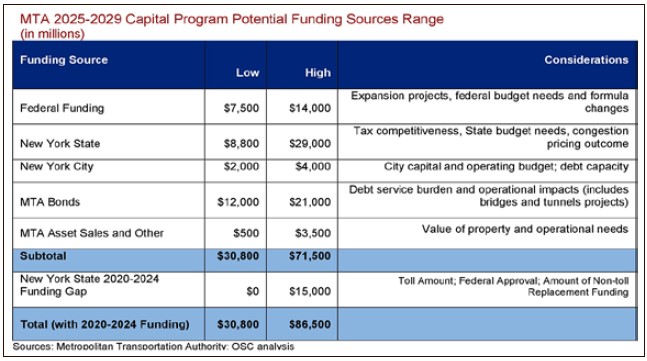

Mr. DiNapoli’s report identifies substantial variation in the MTA’s potential capital needs and uses, ranging from $57.8 billion to $92.2 billion, with a midpoint of about $75 billion. But whether the MTA’s capital program comes in at the low end or the high end of that estimate, it will need significant amounts of new funding, including replacement of the $15 billion that congestion pricing was expected to provide.

Capital Needs

The report suggests a wide range of capital needs are likely to be proposed in the 2025-2029 capital program to maintain and enhance the system, based on needs assessments released by the authority and recent discussion over investment plans.

The most critical funding needs are for keeping MTA assets in a state of good repair. A number of these items cost substantially more than projected over a decade ago, including power substations, repair shops and structures, like the Grand Central train shed. NYC Transit’s Livonia Street and 241st St. repair yards, estimated to need $150 million in repairs in 2013, have been updated to need work totaling $1 billion. Grand Central Terminal was projected to need $150 million in the 2025-2027 period, but is now projected to need $2.7 billion, with a significant portion to be included in the current plan. Mr. DiNapoli’s report estimates the MTA faces a range of $37.3 billion to $55.2 billion in costs for state of good repair and normal replacement projects.

The MTA’s aging train cars and buses are also a significant contributor to capital costs. There are 1,100 subway cars that will exceed their 40-year useful service life between 2024 and 2027, and another 625 that will hit that milestone between 2027 and 2030. When combined with the cost of replacing commuter rail cars, the cost estimate ranges from $8.4 billion to $16.5 billion. Bus purchases would cost another $3.5 billion to $4.5 billion depending on fleet choices.

Severe weather will continue to threaten the transportation system. The MTA’s Climate Resilience Roadmap put a minimum $6-billion price tag on protections against extreme weather over 10 years, but it remains uncertain if those plans will be accelerated or put off, given funding uncertainties.

The Interborough Express and Penn Station Reconstruction might get some funding support from federal and state funds, and could require funding of nearly $4 billion from the MTA’s 2025-2029 capital program.

Under a court agreement, the MTA has to increase subway accessibility to meet the requirement of the Americans with Disabilities Act for all stations by 2055, which may require from $5.3 billion to $8.1 billion in the next capital program, depending on the size of investment in NYC Transit projects.

Funding Options

Most of the MTA’s control over funding for its capital program comes from its ability to issue bonds, but it is constrained by its own targets to maintain a debt burden that does not impact day-to-day operations. Currently, the MTA spends 15 cents out every revenue dollar (15%) of its operating budget to pay off debt. At a low-end target of 13% of revenue, the Authority could issue about $12 billion in debt. A high-end debt burden target of 18%, which would pressure the operating budget, would pay for about $21 billion in debt.

The report assumes between 13% and 18% of increases in MTA-sourced revenue, primarily fares and tolls, could be used to pay debt service. Collecting the estimated $700 million in lost revenue from fare evasion, the MTA could generate about $1.5 billion to $2.1 billion in capital from debt issuance. Doubling fares beyond the 4% increase scheduled for 2025 could add $300 million in revenue, excluding the impact from potential decreases in ridership, increasing the MTA’s bond capacity by $600 million to $900 million. A 5% increase in ridership above current projections would support an additional $550 million to $820 million in bonding.

Historically, the state has provided the MTA with a significant portion of funding for its capital program through taxes and subsidies — even before funding the $15 billion gap in the current 2020-2024 capital program. The report estimates the amounts of revenue that a hypothetical 10% increase in existing MTA revenue taxes would generate, and how much the MTA could borrow as a result. The state may also choose to provide additional direct General Fund support that MTA could use to issue debt. In total, funding from the state for the 2025-2029 capital program is estimated in the range of $8.8 billion to $29 billion, with the low end based on the past five capital programs and the high end reflecting the most recent.

The most critical aspect of state funding remains the $15 billion hole in the 2020-2024 capital program from the congestion pricing pause, which has produced additional pressure on investment choices for the system, and must be addressed prior to answering funding questions in the 2025- 2029 capital program.

Mr. DiNapoli’s analysis assumes that the MTA will receive similar levels of federal funding as in past capital plans, between $7.5 billion and $14 billion, with expansion plans like Interborough Express fueling the higher number.

Based on prior plans and contributed shares, the city’s contribution to the upcoming capital program could range from $2 billion to $4 billion.

The report found that the MTA will likely have more in needs, including system improvement and expansion, than funds available. Effective prioritization and transparency regarding its choices will be critical to generate funding support to maintain and enhance the system, and focus must be on selecting projects that ensure the safety, reliability, and frequency of the system.