Homeownership, Rent Costs Out of Reach For Many Living in H.V. Counties: Report

By JOHN JORDAN – September 26, 2023

NEWBURGH—It’s been a tough year for renters and home buyers in most of the Hudson Valley, and if one study is any indication, things don’t look to be getting easier anytime soon.

A slowdown in the region’s housing market prompted by higher costs and higher interest rates points to an affordability crisis that is gripping many of the nine counties in the Mid-Hudson Region.

A new report shows that higher interest rates, on top of the region’s long-standing shortage of homes for sale, have made a brutal market even harder.

Hudson Valley Pattern for Progress released a new report on Sept. 12 that clearly identifies an affordability crisis for housing in the region, fueled by stagnant wages, increasing rents, and skyrocketing home prices that have stretched household budgets to their limits.

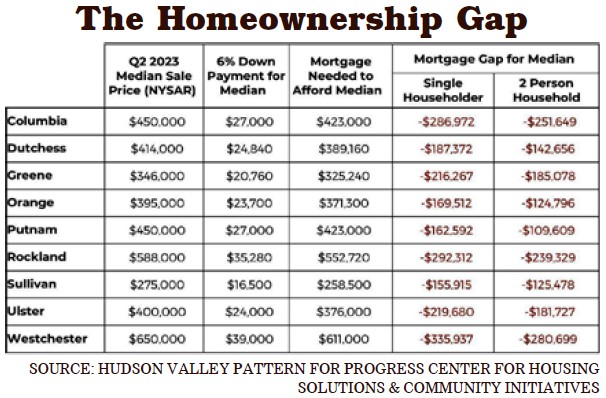

The report, Out of Reach Hudson Valley 2023, uses federal and local data to examine the gap between wages and the cost of rental housing for those living in the nine-county region. Pattern also examined the affordability of homeownership throughout the Hudson Valley by comparing median home prices to the mortgages for which typical families would qualify in each county.

The data show a persistent and clear trend across the entire Hudson Valley: the cost of housing has pushed beyond reasonable levels of affordability for most of our neighbors. A single worker cannot afford fairmarket rent for a one-bedroom apartment in any of the nine counties, and median home prices are more than $100,000 higher than the mortgage that typical families would qualify for in every county, Pattern officials stated.

“The data we analyze each year tell a clear and troubling story: most of our neighbors cannot afford to live in the communities where they work,” Hudson Valley Pattern for Progress CEO Adam Bosch said. “As our neighbors choose to leave the region, have smaller families, and our workforce slowly shrinks, the Hudson Valley is starting to feel some of the most painful ramifications of stagnant housing and zoning policies. Civic leaders at every level must rally around evidence-based solutions to solve our regional crisis of housing affordability and availability. The vibrancy and viability of our communities will depend on actions that encourage the production of more housing at prices our working-class neighbors can afford.”

The Pattern report utilized county-by-county data from the National Low Income Housing Coalition, which examined hourly wages and fair-market rents to measure the affordability of rental housing. (Fair-market rent is the 40th percentile of renters who have moved within the past two years, which means it is lower than median marketrate rents.) Affordability is calculated by the standard that no individual or family should spend more than 30% of its total monthly income on housing. This year Pattern also used that standard to measure the affordability of homeownership in the Hudson Valley. Pattern calculated the mortgage for which households earning the area median income would qualify and compared that to the median price of homes in each county. Pattern examined these data for the nine-county region, including Columbia, Dutchess, Greene, Orange, Putnam, Rockland, Sullivan, Ulster and Westchester.

Key Conclusions

- Single adults working 40 hours per week on average renter wages cannot afford a one-bedroom apartment in any of the nine counties. Renters would need to earn anywhere from $1 to $26 more per hour to afford rent in their respective counties. Renters in every county are considered “cost burdened.”

- Fair-market rents would need to decline anywhere from $33 to $1,343 per month to make them affordable for a person earning average renter wages across the region.

- Families are also stretched thin. Two working adults in a two-bedroom apartment can afford rent in seven of the nine counties. Fair-market rents remain unaffordable in Putnam and Rockland. However, two working renters meet the affordability standard by less than $100 per month in Orange and Ulster counties, which leaves little money left over for other expenditures or emergencies.

- Wages earned by a typical renter ranged from 39%-61% of the area median income, a key metric for housing policies and programs.

- Since 2010, renters have comprised a larger proportion of all households in the Hudson Valley. From 2010-2021, the region saw an 8% increase in renter-occupied households and a 2% increase in owner-occupied households. The growth in renter-occupied households outpaced owner households by 2-to-1.

- The median price of a home in the Hudson Valley exceeds mortgage qualifications for the typical household by more than $100,000 in all nine counties. For a two-person household, the gap is anywhere from $109,609 in Putnam County to $280,699 in Westchester County. Data indicate that more middle-income households are staying in rentals as the cost of homeownership gets further out or reach for a greater proportion of them.

- An analysis of income data found that low-, moderate-, and middle-income earners saw their spending power stagnate or decline from 2010-2021. The trend for the bottom two-fifths of earners, which generally include people making up to $50,000 per year, are of special concern. These workers have seen their wages flatten or decline relative to inflation, exacerbating their financial stress for housing and other necessary expenses. For earners in the lowest two quintiles, the Hudson Valley has seen wage growth that significantly underperformed statewide and national trends.

The data from the report indicate that renters and homeowners in the Hudson Valley have little to spend on necessary and discretionary expenses because the cost of housing is gobbling up a large proportion of their incomes. Many service workers, for example, are living month-to-month with little money left over for savings or emergencies. This has broader implications for the Hudson Valley. For example, migration data from the Internal Revenue Service show that more people have moved out of the Hudson Valley than into it for 24 of the last 25 years—a trend that has resulted in a net loss of 134,505 people since 1996. State education data show there are 34,088 fewer children in area schools than in 1996, Pattern officials stated. These deleterious trends are connected to, and partially caused by, the relatively high cost of Housing in the Hudson Valley.

As a result, the region is now struggling through the early stages of a workforce crisis. Data show that our workforce shortages will also worsen in the next two decades unless the region can see a shift in well-established population trends. Currently, the older half of the labor pool (45-64) outnumbers the younger half (ages 25-44) by approximately 100,000 people.

As the Baby Boomer generation continues to retire in larger numbers, the cohorts of workers coming into the Hudson Valley labor pool are only a fraction of their size. Consequentially, almost every industry sector in the nine-county region is struggling to find enough workers to meet their needs for labor. Pattern explained this trend—and its connection to housing — in a report released this past May entitled The Great People Shortage and its Effects on the Hudson Valley region.

A copy of the report can be accessed at: https://www.pattern-for-progress.org/portfolio/the-great-people-shortage-a-special-report-analyzing-hudson-valley-demographic-trends-and-consequences/

Pattern stated that its “Out of Reach” report’s findings were troubling. “The solutions to our affordability crisis are not simple, and they cannot focus on one corner of our civic structure alone. State and federal governments must work to ensure that our hardworking neighbors are compensated fairly. To meet the demand for housing, state and local

governments must adopt significant changes to land-use and housing policies that support the kind of development that is affordable for our residents. These efforts must include deeply affordable rentals as well as new opportunities for homeownership; many tenants are paying more in rent than they would on monthly mortgage payments, but traditional pathways to homeownership are unviable due to prices that have far outpaced incomes.

The Out of Reach report can be accessed at: https://www.pattern-for-progress.org/portfolio/out-of-reach-2023/